41+ how to get a mortgage when self employed

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Other ways to get a mortgage approved with one year of self-employment Self-employed home buyers without two consecutive years of self-employment tax.

Mortgages For Self Employed Buyers Which

Ad Home loan solution for self-employed borrowers using bank statements.

. Some of the steps you should take. Web When applying for a mortgage expect lenders to request and review the following employment and income documents. If you run your own business or receive 1099s you may be considered self-employed.

Less Paperwork and Hassles. Purchase Refi Options. Web If you are a W-2 employee you are considered salaried.

Web Web Highlands Residential Mortgage is a privately-owned mortgage lender with 530 employees and over 40 branch locations in 16 states. Web A mortgage lender will consider you self-employed if you own more than 20 to 25 of a business from which you earn your main income. Lenders may also want a copy of an SA302 form for self-assessment taxpayers or a tax year.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Because you do not have. Web The best way to increase your chances of being approved for a mortgage is to be prepared especially if youre self employed.

Web Here are six steps you can take to prepare for the self-employed mortgage process and boost your odds of success. Less Paperwork and Hassles. Purchase Refi Options.

No Tax Returns or W2s are Needed. Web You will need to demonstrate that youve been self-employed in the same line of business for the last two years before that income can be considered for your loan. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

Web Consider the following to increase your chance of being approved for a mortgage while self-employed. Apply Online To Enjoy A Service. Web 1 Annual saving based on re-mortgaging 205335 from the highest big 6 lender standard variable rate at 749 to a 5 year fixed rate of 394.

Web How do you qualify for a mortgage if you are self-employed. Web How To Get Mortgages for Self-Employed. Many self-employed business people have faced a problem of not qualifying for the mortgage due to several reasons.

LTV 50 less fees 999. A strong credit score history is integral to most financial transactions especially a self-employed mortgage. Do Not Add More Debt.

Highest Satisfaction for Mortgage Origination. No Tax Returns or W2s are Needed. Ad Americas 1 Online Lender.

Our mortgage experts will walk you through every step of the process- fast and worry-free. Keep tax deductions to a minimum. Compare Rates Get Your Quote Online Now.

Ad We Use Bank Statement to Qualify. It sounds counterintuitive but self-employed workers should write off fewer expenses for at least two years before applying for a mortgage. Ad See How Competitive Our.

Web As a self-employed mortgage applicant making sure your credit score and credit history are in the best possible shape will set you up for success when applying for. A great credit score Credit score is a major factor in landing a mortgage. Web 5 steps to getting a mortgage.

If youre confident you can qualify for a self-employed mortgage heres an overview of how to apply. My team and I have a solution for yo. Ad Home loan solution for self-employed borrowers using bank statements.

Employment verification A copy of your. Save Time Money. Optimize your credit score.

Web Tips During the Application Process. Do not take on any other new debt before you apply or while your application is being considered. Determine if you need a self-employed.

Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool. Web To get a self-employed home loan apply after earning at least two years of steady income while working for yourself. Raise your credit score and put down the.

Ad We Use Bank Statement to Qualify. Calculate what you can afford. Our mortgage experts will walk you through every step of the process- fast and worry-free.

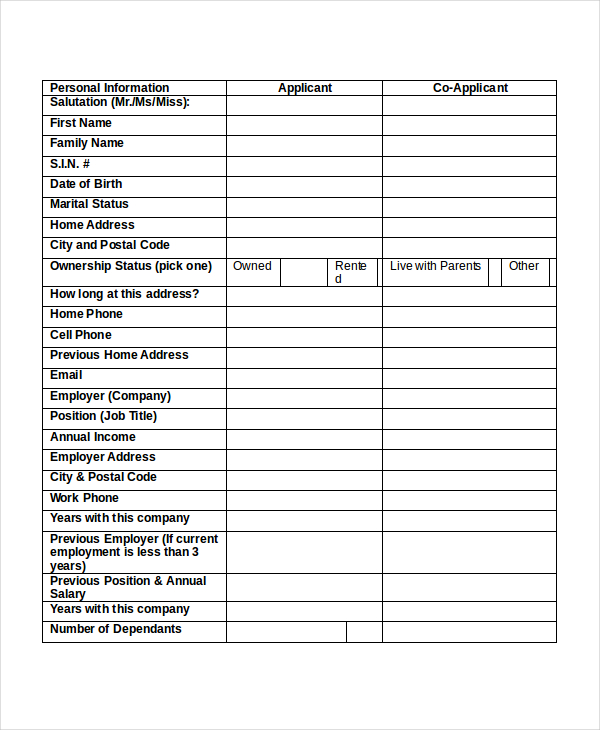

Ad Get Instantly Matched With Your Ideal Home Loan Lender. Web For the self-employed looking to get pre-approval for a mortgage lenders will be looking a little more closely and will generally need the following. The reason is that it gives.

Web Heres how a lender uses that DTI number to calculate your home buying budget. If youre looking to get a self-employed mortgage the following tips will help improve your odds of approval.

How To Get A Mortgage When You Re Self Employed

Business Credit Workshop

How To Get A Mortgage When You Re Self Employed Freeagent

Mortgage Finance Bowral Mittagong Moss Vale Goulburn Mortgage Choice

1282 Lick Street Moravia Ny 13118 Mls 406811 Howard Hanna

Getting A Mortgage When You Re Self Employed

How To Get A Mortgage When Self Employed Bankrate

5 Tips For Mortgage Success If You Re Self Employed Independent Mortgage Experts Ltd

Getting A Mortgage When You Re Self Employed Moving Com

How To Get A Mortgage When Self Employed Tembo Blog

Free 10 Sample Mortgage Application Forms In Ms Word Pdf

Can I Use My Last Years Self Employed Income For A Mortgage Niche Mortgage Broker

How To Get A Mortgage When You Re Self Employed Freeagent

Free 10 Sample Mortgage Application Forms In Ms Word Pdf

How To Get A Mortgage When You Re Self Employed

The Mortgage Brothers Show Signature Home Loans Phoenix Az

How To Get A Mortgage When You Are Self Employed